Types of Life Insurance

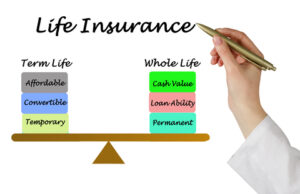

Life insurance typically falls into two categories:

Term Life Insurance

- Term insurance provides protection for a specific period of time. The term is often 10, 20, or 30 years. This makes excellent sense when you need protection for a specific amount of time – for instance, until your home mortgage is paid off or your children graduate from college. Term insurance typically offers the largest death benefit coverage at the lowest initial premium. This can make it a good choice for those on a tighter budget.

Permanent Life Insurance

Permanent Insurance provides lifelong protection for you as long as you pay the premiums. It also provides “living benefits” such as the ability to accumulate cash value on a tax-deferred basis, which you could choose to tap into for retirement funds, to help buy a home, or to cover an emergency expense.

- Whole Life Insurance

Whole life insurance is one type of permanent life insurance that remains in force for your entire lifetime, provided premiums are paid as specified in the policy. Whole life insurance can be an investment opportunity, as many whole life insurance policies build cash value over time. - Universal Life Insurance

Universal life is another form of permanent life insurance characterized by its flexible premiums, face amounts, and unbundled pricing structure. Universal life can build cash value, which earns an interest rate that may adjust periodically but is usually guaranteed not to fall below a certain percentage.

Sometimes, a combination of term and permanent insurance is the best way to cover both short- and long-term needs.

Need an insurance quote? Get in touch!

Access quotes from some of the Pacific Northwest's most trusted insurance carriers. It's comparison shopping at the click of a mouse.